- #Texas ag exemption number search pdf#

- #Texas ag exemption number search registration#

- #Texas ag exemption number search download#

Properties are eligible for ag valuations for the production of everything from honey to hay and can even be eligible for wildlife management depending on the location and rules of the county.Īg valuations are not easy to get, so it’s very important to keep and maintain them. The idea of agricultural land valuation is literally rooted in the Texas Constitution, and can equate to significant tax savings, because let’s face it any type of agricultural land is not cheap to maintain or operate. In simple terms this means agricultural landowners will have their property’s taxes calculated based on productive agricultural value, as opposed to market value of the land. Well, an ag exemption is not really an exemption, but instead is a special valuation. One of the principals we feel really separates us from traditional mortgage lenders is that we allow agricultural exemptions to remain on the property. To serve our clients that live on acreage, we here at Texas Farm Credit have some unique products and guidelines. We offer products for individuals that thrive in the hustle and bustle of the city as well as those that need a little more wide-open space.

#Texas ag exemption number search download#

Go to Acrobat Reader download for the latest version.The type of properties we lend on are as diverse as our group of borrowers. If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms.

#Texas ag exemption number search pdf#

The county appraisal district forms and documents that may be downloaded from our website are in Adobe Acrobat Reader PDF format.

#Texas ag exemption number search registration#

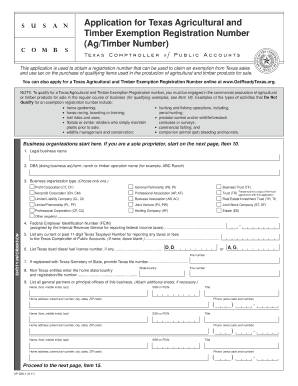

The form used to apply for a Texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below.ĭownload Agricultural and Timber Exemption Registration Number form. Plus, the owner pays 7 percent interest for each year from the date the taxes would have been due. The rollback tax is the difference between the taxes paid on the land's agricultural value and the taxes paid if the land had been taxed on its higher market value. The rollback tax is due for each of the previous five years in which the land received the lower appraisal. If land receiving an agricultural appraisal changes to a non-agricultural use, the property owner who changes the use will owe a rollback tax. However, land within the city limits must have been devoted continuously for the preceding five years, unless the land did not receive substantially equal city services as other properties in the city.

Agricultural land must be devoted to production at a level of intensity that is common in the local area.Wildlife management land must be used in at least three of seven specific ways to propagate a breeding population of wild animals for human use. TheUsing land for wildlife management is an agricultural use, if such land was previously qualified open-space land and is actively used for wildlife management.Land used for raising certain exotic animals (including exotic birds) to produce human food or other items of commercial value qualifies. It also can include leaving the land idle for a government program or for normal crop or livestock rotation. Agricultural use includes producing crops, livestock, poultry, fish, or cover crops. The land must be devoted principally to agricultural use.Property owners may qualify for an agricultural appraisal status if their land meets the following criteria: There is a rollback tax for taking agricultural land out of its productivity use. Landowners must use their land for agriculture. Typically, a productivity value is lower than the market value, which results in a lower property tax. Landowners may apply for this special appraisal status based on their land's productivity value rather than on what the land would sell for on the open market. Therefore, it is actually an agricultural appraisal. It is a county appraisal district assessment valuation based on agricultural use. The Texas agricultural exemption is not technically an exemption.

0 kommentar(er)

0 kommentar(er)